is a car an asset or expense

A quickly depreciating asset. Assets vs Liabilities To understand whether your car is an asset or not you need to understand.

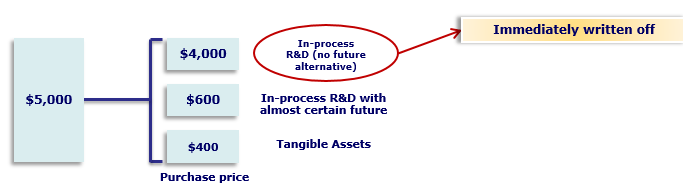

Accounting Basics Purchase Of Assets Accountingcoach

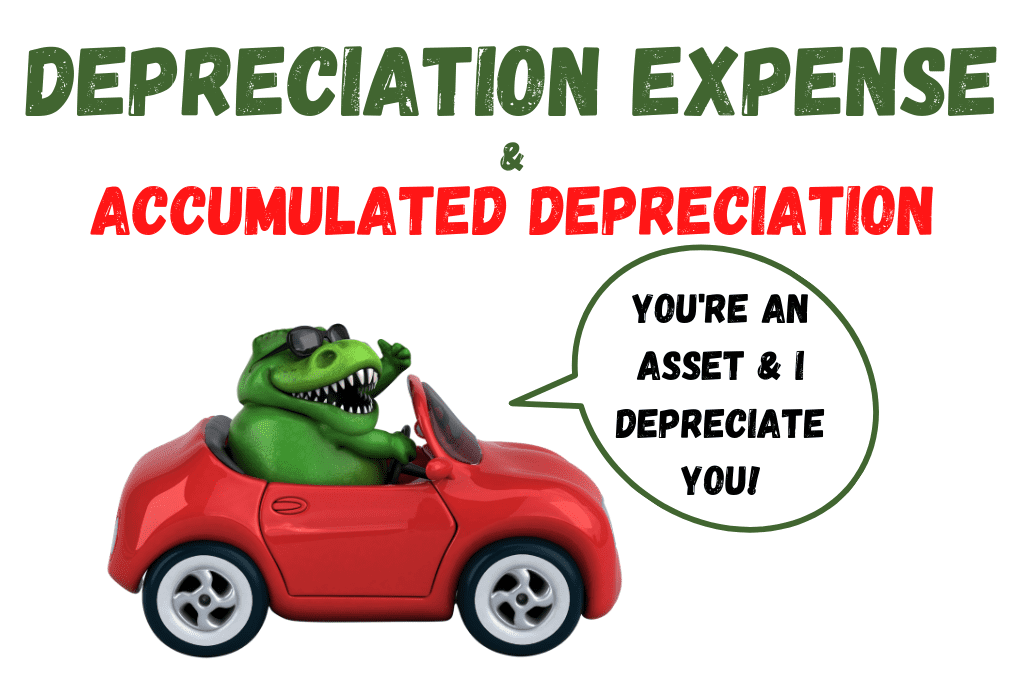

An asset can become fully depreciated in two ways.

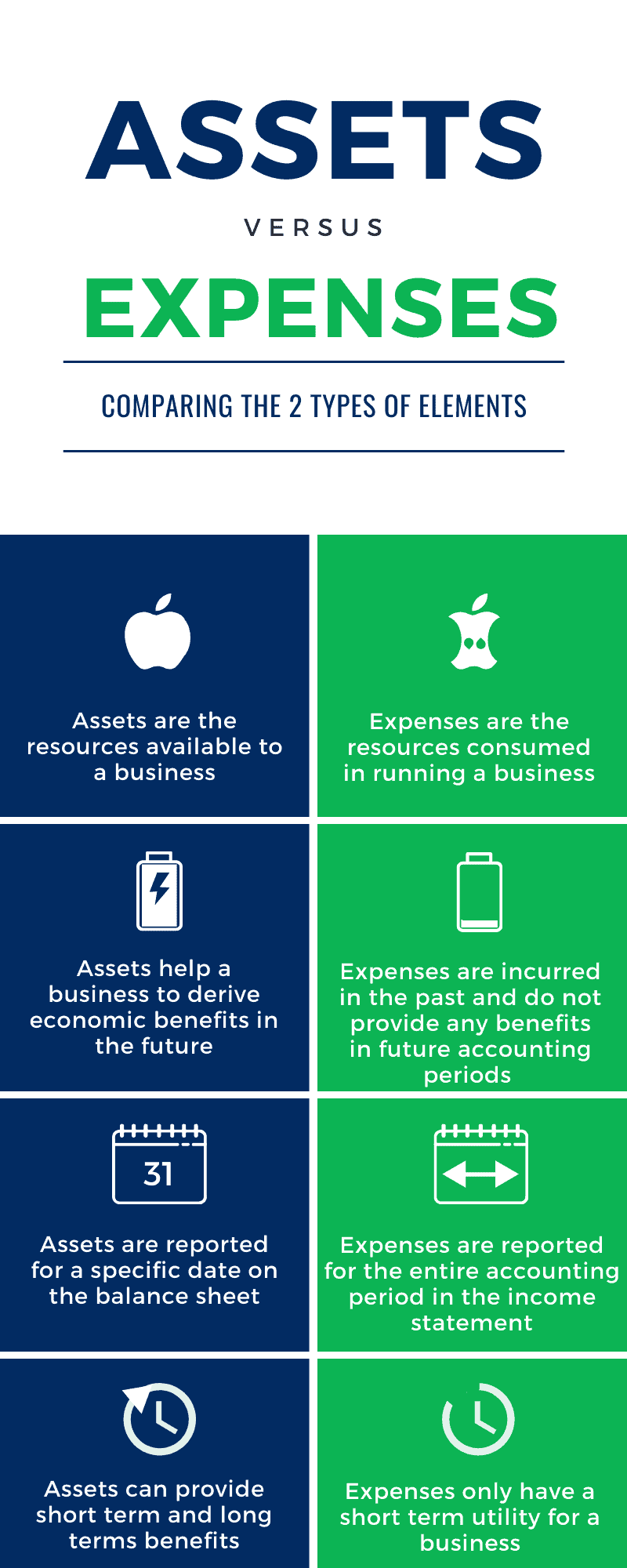

. Expenses are the cost that company spends to support operations and generate revenue. A fully depreciated asset is an accounting term used to describe an asset that is worth the same as its salvage value. Company spends to get the work done.

But what about those lower priced but important items. When you buy an asset the purchase price is not considered an expense. The short answer is a car is a depreciating asset but there is a little more to it.

The car is an asset since it is something that has value. A botched or poorly completed renovation is an expense not an asset. It includes things like.

The car is an asset since it is something that has value. Yes a vehicle can be considered an investment but that answer comes with a truck-sized caveat. Table of Contents Assets vs Liabilities To understand whether your car is an asset or not you need to understand exactly.

You want experience a written bid license and proof of liability insurance and workers compensation insurance. If youre on a work trip any transportation services you use to. Manufacturers have been preaching this for years as a way to quantify the benefits of purchasing premium.

Under the simplified depreciation rules you depreciate improvements to assets. Sometimes its obvious whether something is an asset or an expense. Paper clips are an expense.

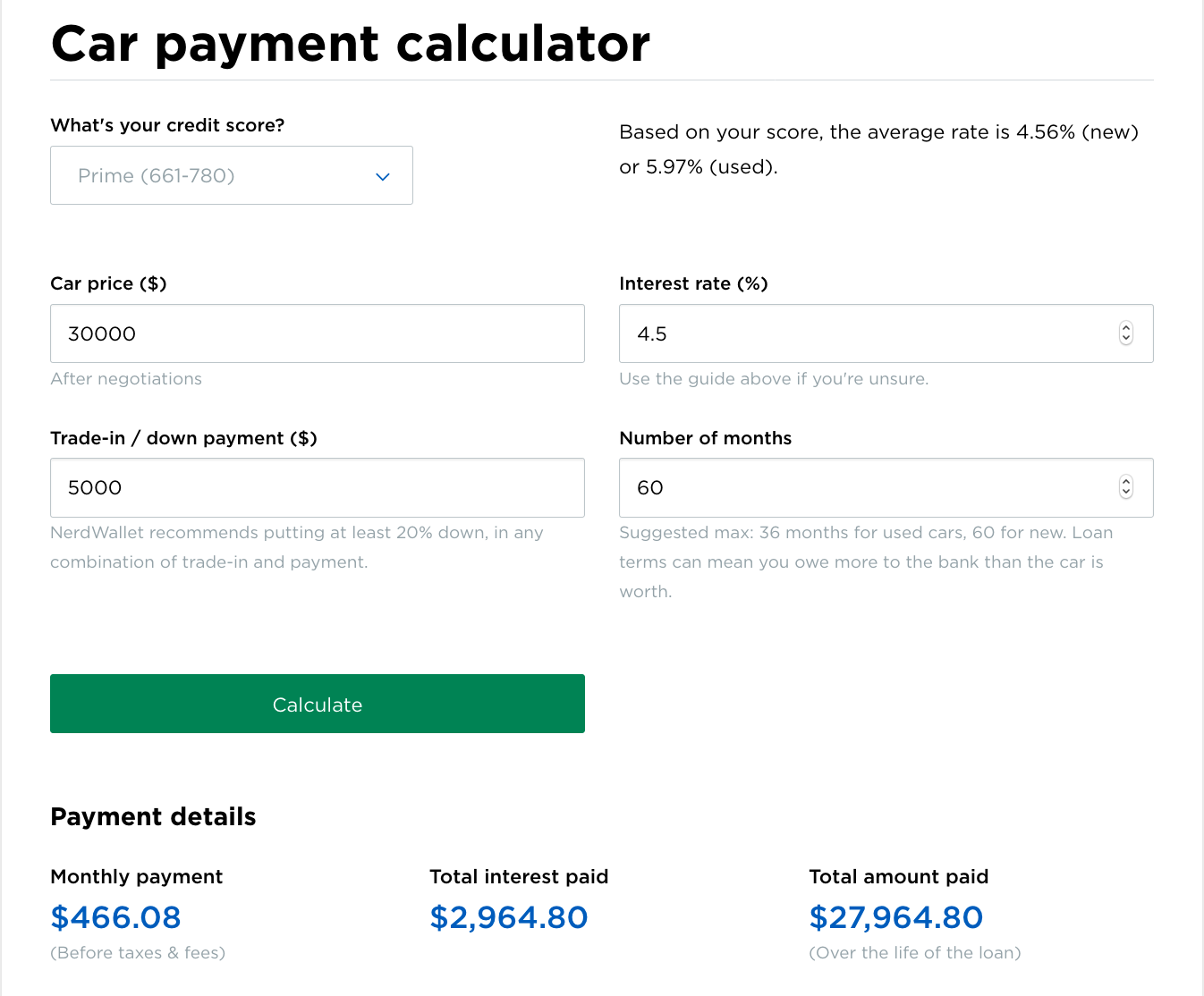

One of the key differences between the two involves how long the item will be in. Both fixed asset purchases and expenses involve spending money to purchase goods. Although your car is an expensive purchase this does not mean it is an investment.

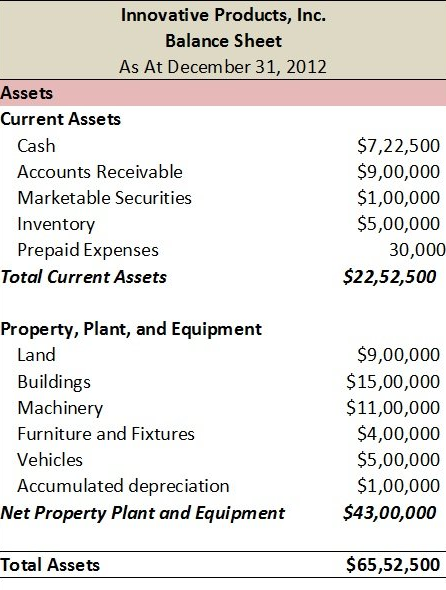

It is based on the expenses you actually incur in the operation of your vehicle. The car itself is an asset. Along the way you.

However for tax purposes most companies choose to expense the costs in the. Many people consider a car an investment because of the large price tag. The life-cycle cost approach to tire management isnt new.

When you buy you pay fees taxes insurance take a depreciation hit. A car is an asset. Gas purchases repairs oil changes tire purchases car washes.

Generally the development of a website should be considered an asset to be amortized over its useful life. Unlike an asset expenses do not maintain their worth for more than a year because the. Depreciation has been defined as the diminution in the utility or value of an asset and is a non.

For example a depreciation expense of 100 per year for five years may be recognized for an asset costing 500. In order to distinguish between an expense and an asset you need to know the purchase price of the item. An expense is a purchase for the operation of a business that is usually less than 2500.

A car is both. The principal portion of the loan payment is a reduction of the loan balance which is reported as a Note Payable or. Only the interest portion of an automobile loan payment is an expense.

Unless youre talking about a rare and perfectly maintained car like a 1964 Ferrari 250 LM or a 1994 McLaren F1 then its highly unli See more. Understanding what they are will help you identify what is and isnt considered a travel expense. If the improvement relates to an existing asset in your.

Expenses will be deducted from total revenue to get. Rare and exotic cars actually increase in value as the number of road-worthy models decreases. Anything that costs more than 2500 is considered an asset.

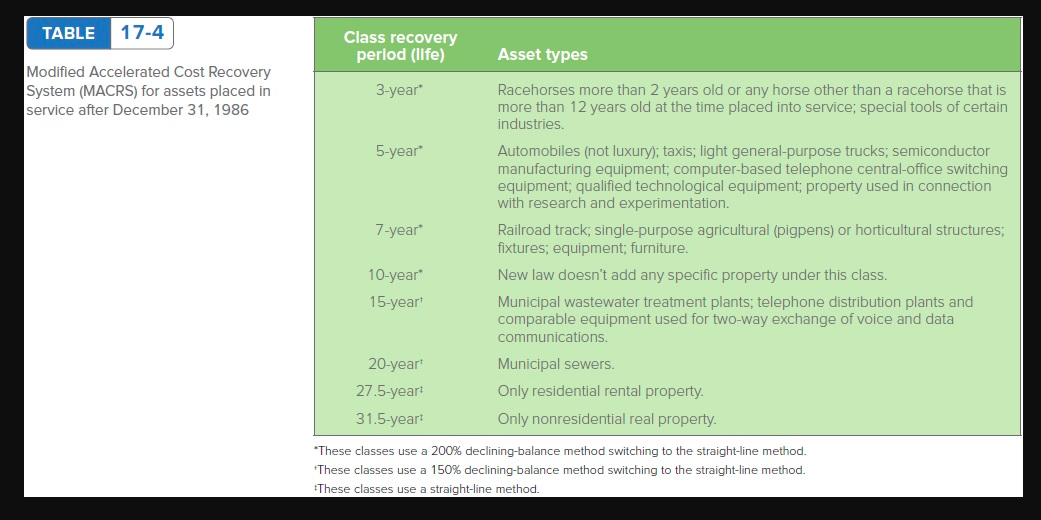

Solved For The First 2 Years Calculate The Depreciation Chegg Com

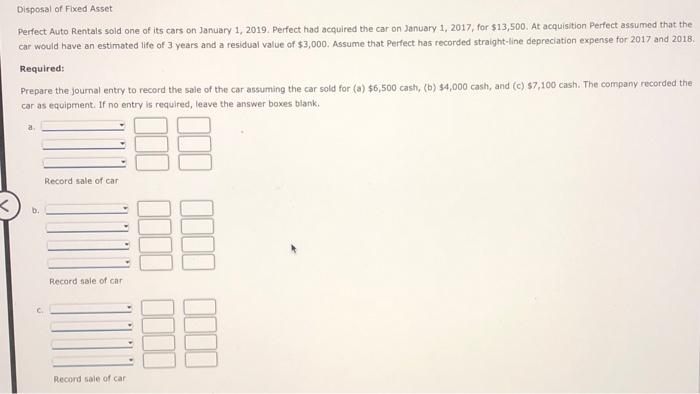

Solved Disposal Of Fixed Asset Perfect Auto Rentals Sold One Chegg Com

Chart Of Accounts Explanation Accountingcoach

Is A Car An Asset Or Liability Money Bliss

Your Car An Asset Or Liability Aving To Invest

Income Generating Asset Vs Expense Generating Asset Know What You Re Buying By Mai Ho Medium

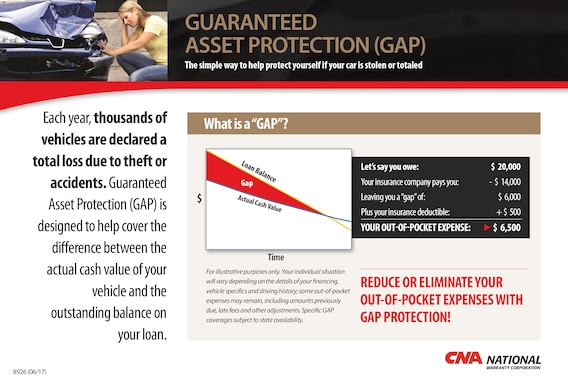

Guaranteed Asset Protection Hastings Ford Lincoln

What Is Depreciation And How Is It Calculated Article

Is Your Purchase An Asset Or An Expense Skynar Bookkeeping

Difference Between Assets And Expenses Accountingo

Alice Assets Liabilities Income Capital Expenses Study Zone Institute

Cbs Pty Ltd T As Clever Business Synergy Thinking Of Purchasing A New Car Here Are Some Facts About Instant Asset Write Off Car Limit For More Information You May Click This Link

What Is Depreciation Accounting Student Guide Accounting How To

Plant Assets What Are They And How Do You Manage Them

Turn Your Car From An Expense Into An Asset Erica R Buteau

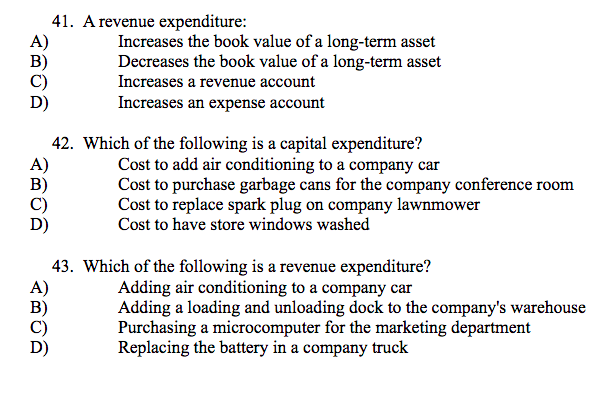

Solved 41 A Revenue Expenditure A B Increases The Book Chegg Com

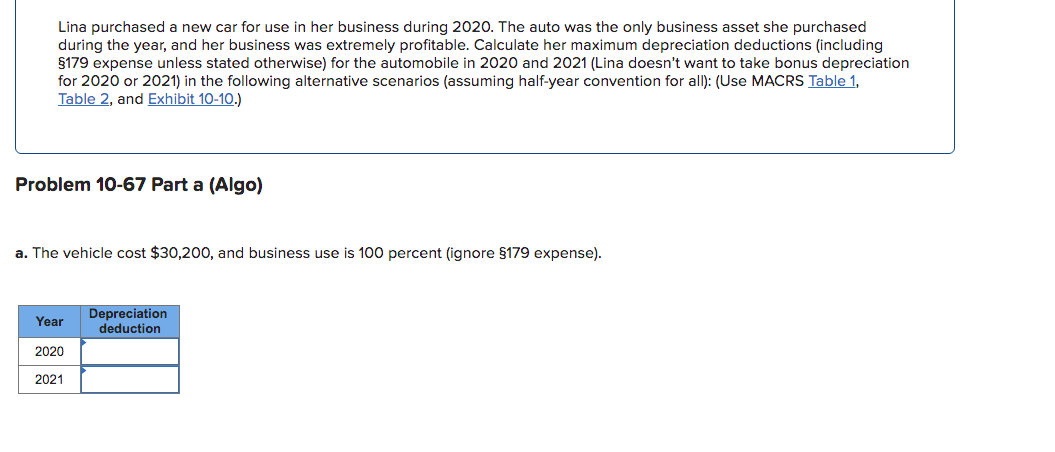

Solved Lina Purchased A New Car For Use In Her Business Chegg Com

Accounting Basics Purchase Of Assets Accountingcoach

What Are Expense Ratios How Do They Work Nextadvisor With Time